People think physicians make a whole bunch of money. They do make good money, but still have to live from day-to-day. After learning from a patient about real estate investing, Dr. Felecia Froe – a respected urologist with over 25 years’ experience as a physician – decided to dip her toes into the industry. Today, Dr. Froe is now the Founder and CEO of Narwhal Investment Group, a champion for Well Being Matters for Women, and a successful real estate investor with over $100 million in assets under management and a focus on investing to impact communities positively. Today, she joins Lisa Hylton to talk about impact investing and how you can combine real estate and making an impact in the community. They also take a closer look at women and investing and how Dr. Froe is helping them become more confident.

—

Watch the episode here

Listen to the podcast here

Impact Investing Thru Residential Assisted Living And Agriculture With Dr. Felecia Froe

I have another amazing episode with another amazing guest to bring to you. Her name is Felecia Froe, MD. She is a licensed board-certified urologic surgeon and graduate of the University of Missouri. She is a respected physician, with years in the medical field. Dr. Froe is also a successful real estate investor and syndicator with over $100 million under management with herself and her colleagues. I am super excited to have her onto the show. Welcome, Felecia.

Thanks, Lisa. I’m glad and excited to be here. It is nice to meet you.

It is nice to meet you as well. We have a mutual friend, who is Monick Paul Halm and you were a part of her book, Wealth for Women: Conversations with the Team That Creates the Dream The Top Female Professionals Who Can Help You Get Wealthy in Real Estate (A Message In A Bottle). I’ve also seen you in many pictures with the real estate people. I thought, “This is an amazing black woman who is playing in the field of real estate. I would love for her to come on my show and share with my audience about her real estate journey of making it come alive, balancing career and investing in real estate.” How did you get started investing in real estate given your medical background?

It’s been a journey, but we started investing back in 2004. It was when I was in practice in Kansas City, Missouri. I was working with some other women physicians to open up a women’s center, an OB-GYNE. I’m a female urologist, which isn’t the most common thing in the world. Another woman who had done very well in business was with the group. She wanted to do a little bit different type of thing than we worked with her. She told me to read the book, Rich Dad Poor Dad, by Robert Kiyosaki. I got and read the book. Since then, I’ve been about the different ways to make money and quadrants. That was the beginning for me. In 2004, we bought our first property. That was after one of my patients had come in. She seemed to be able to come whenever we give her an appointment, she’d show up. I asked her at one point, what does she do for a living? She said that she’s a real estate investor. We spent the rest of her appointment talking about real estate investing and not her urologic problem.

We became friends. A house came up and I called her and said, “Would you go look at this with me?” Her name is Jamie. She showed up. We walked through the house and she said to me, “I think you should buy this house. If you don’t buy it, I’m going to buy it. If you buy it, I’ll let you use my crew to fix it up. If you buy it and rent it and it doesn’t make you money, I’ll buy it from you.” I was like, “I’ve got nothing to lose.” Back then, this was a VA house and it was $500 down. It was in the year 2000 that this happened. We bought that house and that was the beginning. We bought eighteen houses in the next two years, then 2008 happened.

What was the situation with your portfolio going into 2008?

We bought fast as you can imagine. We had eighteen houses within two years with different ways of financing them. Every financing was easy. You could get a loan. We would borrow some money and borrow enough money. It was an interesting time where you could borrow more than the house is worth so you could fix it up. We’re in this position and we had 4 to 6 houses in rehab. In 2008, the crash came. It turned out that we didn’t have enough money, enough time, enough anything to get all those houses rehabbed. We borrowed money to try to get it all done. Things didn’t go well. At that point, we ended up with short sales foreclosures. That was the low point of my real estate investing. That was the dag on it.

How did you recover? For a lot of people when they get to that place, they might say, “I’m out of the real estate,” but you’re still in real estate these days. What happened?

I got divorced around all of that. It was a bad situation, but I’d like to think, “What happened? I read all these books. I’ve talked to these people and real estate is good. We were in different clubs. What did I do wrong?” That’s what I looked at. Where did I mess up here? It came up that it is under-capitalized. You can’t go into a project without enough money to do the project. I didn’t have a good team. Our team was poor. Those were the two big things where I was like, “This is not a real estate problem. This is a knowledge problem. This was an execution problem.” Real estate still looks good to me. There’s no reason for me not to do this.

How do you put play in real estate these days?

People think physicians make a whole bunch of money. They make good money, but still have to live from day-to-day. Share on XPeople are probably wondering, “How did you come back from that?” I made money in my job, but it’s real. People think physicians make a whole bunch of money. We make good money, but we can still live from day-to-day. Being able to save a lot, we would take a while to save enough to get back in, especially 2008 to 2012. Nobody was lending anything. I made a decision. I moved my job. We were living in Hawaii at that time. I loved Hawaii, but we moved to California to a job where we were given a big huge signing bonus to come on. It’s like, “I’m going to do this, get this money and buy some houses,” which is what I did. That’s how I got back in and started again. I got a great management team. I live in California from Kansas City. That’s where our properties are because I know that area. I have a management team there and I have a lot of friends there too. If something falls apart, somebody can get there to work it out for me. That’s how I got back. That was from 2011 to 2013.

When you got back, you continued to make investments in Kansas City.

I bought three single-family houses. I had crappy credit as you can imagine. It was bad. I had to buy an all-cash. I was buying houses with cash, rehabbing with cash, getting renters in there. It was a challenge. You get up and you go, “I believe in this and I need to go.” I had an accountant at that time who introduced me to the real estate people. That’s how I met them. I started going to a lot of their events where I started meeting a lot of people, learning different markets, learning a lot more about real estate, and upping the game. The biggest thing to me with real estate investing or anything new is getting around people who also do it and who do it better than you do so you can level up your game.

Through them, I learned about syndication. Syndication is where you find a deal and you aggregate money from investors to buy a big deal. I was in their Syndication Mentoring Club and Syndication Inner Circle for years. I learned all about that. I did still have my single-family house. I have four single-family houses in Kansas City. I have business partners in Kansas City where we have a residential assisted living home. I am also working in Tulsa in another syndication with food access. I’ve evolved. I’ve also done some multifamily deals and learn what interests me in real estate. Apartments don’t interest me. It’s not an exciting thing.

Where I am with this impact investing, you can combine real estate and make an impact on this community with food access, grocery stores, food deserts and hydroponic grow houses. We’re bringing jobs to this community. This is what’s feeding me and making me want to do real estate and bring people in. The first thing was the assisted living. When I went and learned about that, it’s like, “This makes so much sense.” You can give an older person a nice place to live in. Their family can feel comfortable about them being there and you make money. It is everything. I don’t have a not make money project, but it is possible. One of the guys says, “You do well and good at the same.

It sounds like where you’re at in your investing personally has impact investing. Investing in providing an impact to the communities in a positive way. One of the ways you’re doing is playing in the space of residential assisted living. Also playing in the space of retail, but I’m not quite sure.

I’m calling it agriculture. If you want to put it under the umbrella of agriculture, that will help people understand what it is. It’s growing food.

I want to dive into each of them separately. Starting with the residential assisted living, what was the process like for you being in the single-family area moving into the residential assisted living?

It was learning. There’s going through and the more you’re involved with real estate, the more you go to different events. No matter who’s an event it is you, you talk to people. You can’t go and sit there and read a book or not interact with people. You have to interact and you find out different things. I was at one and learned about this guy who had Residential Assisted Living Academy. He was teaching people how to do this. He had done it and he said, “Let me teach other people because there’s a silver tsunami.” Baby Boomers are getting older. They’re living longer and they’re going to need someplace to be. I went to his course, learned about it and got a business partner. First, we were looking in Las Vegas and had two houses under contract to buy.

This is not that easy. All fell apart at the last minute. They’ll shift different contract things that can fall apart, serendipitously. I was at a goal’s retreat and a guy that I happened to know from the real estate events was there. We started talking about residential assisted living because I want to do that. I was like, “I happened to see Facebook and they’re going to be in your town in Kansas City. There’s going to be a meeting talking about it.” He was all in. He went to the course. He and another guy did a bunch of research a lot of work around it in Kansas City. He found out which little town in Kansas City was going to be the best. Where do you live?

Impact Investing: Syndication is where you find a deal and you aggregate money from investors to buy a big deal.

I live in LA.

In LA, there’s Inglewood and there’s all this. Kansas City has it too, but not quite as spread out. We’re in a town called Shawnee because that’s where we could have the most beds and we can find a good house. The neighborhoods are nice. It’s in an upscale neighborhood around a lot of upscale things in it, but not the most expensive house in the world. We bought a house, rehabbed it, and we’ve been open since. Running this business is a different thing than having a real estate. While real estate is a business, you have your tenants in there. Running a full-fledged business like a residential assisted home is a completely different animal. We’re learning a lot. I raised money for that. I came into those guys because I have experience in raising funds, raised money to help get that thing going. We already have our group of investors and we are running the business. We’ve had different problems, our manager quit and we have another. All kinds of stuff can go wrong on that. You’ve got to level up, figure it out and keep going. I don’t know if you know Marie Forleo and her book, Everything Is Figureoutable. You’ve got to realize, “I’ve got to figure this out.”

You own both, the real estate and running the business.

We have an operator. My partner, Justin, is there and he’s the overseer of the operators. He’s very much of a systems guy. He’s a retired Navy. He was in the Navy so he’s systematic much more than I am. He’s making sure all the systems are running and trying to keep everybody calm when people are panicking about stuff. I’m glad he’s there because there’s day to day that is not something I want to do. I have my day-to-day. “I hear about it. We can strategize on how we’re going to deal with that issue.” We talk about that issue. We have a good operator so it’s exciting. We’re starting to fill up and hopefully be profitable quickly.

What was the process like to find the operator?

The first operator we found when one of the business partners went to a class to learn how to be an operator. None of us wanted to be an operator. I guess we better figure out what this is. He met a woman there and eventually, we used her as our operator. She got the place built. She started doing marketing and then once people started coming in, it was overwhelming for her. She decided to move on to something else. We got the next operator I don’t know if it was by advertising online, indeed one of those things. Justin was handling that. We hired her away from someplace else, which is good. We got her because she had turned around businesses before. She came in when businesses had low census and built them up to high census. She’s very smart and very good.

Let’s dive into the agricultural side of impact investing. Can you talk a little bit about the process of getting into that side of the business?

That one was interesting too. Going to conferences, meeting people, people understanding what I do and put my fundraising. Honestly, I wasn’t 100% sure where I would need to be in real estate. This guy was doing this project in Oklahoma. He knew that I did fundraising and asked me if I would come and be on his team. That was in September 2018, so I did. I’m still on this team. This guy who brought me in is no longer on the team. We have this other group of people who are working in Tulsa to build hydroponic greenhouses, take old warehouses, convert them into hydroponic grow houses. I’m working with the city and the housing authority to put grocery stores in food desert areas. I’ve learned a ton about government grants and government funding and all that kind of stuff working with these guys that we’re doing. It is stressful. We’re at this point where we need to raise some money and it’s not coming fast as we needed to come. There’s a stress of that. Every project seems to be that way.

How do you personally deal with the stress that comes with that aspect?

It is in different ways on different days.

Running a full-fledged business like a residential assisted home is a completely different animal than real estate business. Share on XYou were coming from yoga before this interview.

There’s yoga. There’s his final crying. There’s that glass of wine. There’s talking and venting to people who understand what’s going on. The best thing about your friends and people who are real estate we can talk to is, as women, we can get emotional about a project or emotional about an event that I can talk to. One of my friends who’s a woman also, she’s like, “Get the emotion out of it because this is a business thing.” I’ll take my deep breath. She walked me through writing this email to this guy, who’s one of my business partners who was working me up. There’s this whole process. What I love about it is how I feel like I’m growing and learning more about myself. Not just real estate investing, I do a lot of personal development work, working with different coaches. I have relationship coaches, not just my relationship with my partner, but also general work relationships.

I’m trying to make sure it is all communication. How are you communicating? How did you think that came across? How does that person need to hear that? Those kinds of things are invaluable. We know the majority of our misunderstandings are no communication problems. We think we’re understanding each other and we’re on completely different pages. I had that with one of my business partners. We were talking on the phone. He thought I said one thing and I said a different thing. We talked about it for ten minutes before he realized, “We’re talking about something different.” I think the overall development of yourself and understanding yourself is as important as what you are doing. It will help you to level up. You set your goals and you have to become the person that can get that goal. That’s the development of yourself.

You have mentioned the team. I’d love for you to talk about the importance of building or being on teams.

Business partners will and break your project. I can’t say that I’m perfect as a partner. I’m learning a lot as I’m going along. My first actual full business partner project was the residential system living. The two of us get along and understand each other. We seemed to be on the same page, when one of us is not. We struggle to keep us all together in that scenario. That being said, I do want somebody who thinks like me, but that’s dumb then because one of us is redundant. You need somebody that’s going to challenge you to think and see differently and help you move to something better. I don’t like pro forma. I don’t like to run numbers. I don’t like putting them together. It gives me a headache. Justin, my business partner, loves doing that. Justin runs these numbers. What does this look like? He sends me the spreadsheet and tells me how he got all these things, then it makes perfect sense to me. With him being that numbers guy, he is more of a methodical, less reactionary personality.

I’m logical. I’ve got a little bit more emotional as I’ve got older. I don’t know why. It seems weird, but I notice it. I’m more in the relationship. I want to talk to you. I want to get to know you. I want to do that thing, which is why I enjoy the fundraising part because it’s not just taking your money. I want to know what you’re trying to do with your money. What are you trying to accomplish with your money? That’s where I shine in that environment. If that’s what I know I like to do, I have to set it up so that all the other stuff that needs to get done can get done. Either I’m going to have to do it, which is not going to be done well and I’m going to hate my job or I have to get somebody else either on my team, a virtual assistant. Somebody else to handle all these different things that I am not good at and doesn’t generally like to do.

We have a team in the Oklahoma project. There are six of us there. I’m fundraising. There’s a guy who knows a lot about government grants. He’s also a master grower. He’s going to handle a lot of the hydroponic growing. We have guys who have grocery store experience. We have a realtor and an IT guy. This vertical of people are together. Are we smooth? No, you can imagine, our personalities are different because of what we bring to the table, but we have to. We oftentimes forget that we do bring different things to the table. We have to try to understand what the other one’s trying to say so that leads to some heated conversations. We can’t shy away from heated conversations. It’s a conversation that needs to be had. That’s that personal development because nobody wants to argue. Nobody wants to have a difficult conversation, but you have to have them if your business is going to grow and move forward.

One other thing that you’ve touched on a lot here is how you’ve met your partners. A lot of times, it’s been organic, but you’ve put yourself out there by going to conferences, which ultimately enabled you to meet people as well as share what it is that you do. People know that this is what you do and then wanted to partner with you. Coming from that place, what advice do you have for people as they think about going into partnership with other people, things that they should be aware of and note?

If I were doing partnerships, I tend to trust first and then you do something that makes me not trust you. That’s my personality. I have a partner, my life partner is, “I don’t trust you until you earn my trust.” We are different that way and that’s frustrating to me. I see the benefit of both of those ways. They can keep me from getting in too much trouble. That’s been my biggest problem. When I form a partnership, it’s like, “Let’s do it,” and then find out, “We don’t click. We have different values. This doesn’t seem to work.” It hasn’t been bad where I’ve broken up a partner where we like, “This is not working.” I haven’t had that, but it’s been adjusted. I haven’t been with people that are so off-kilter from what I am that it’s not tenable. It’s growing. It’s understanding how to deal with people that aren’t like you, which we have to do or we don’t grow our business or our personal lives.

How have you navigated working with people who are different from you?

Impact Investing: You need somebody that’s going to challenge you to think and see differently and help you move to something better.

I talk to a lot of different people. We’ve got a little tension in our group that we’re working through. It’s differences of opinion that you have to work through their normal kind of things. I’m talking to this person in the group and I’m like, “I don’t know if you’re understanding what I’m saying.” We’re talking, but you could walk away from a conversation not feeling like you were heard or understood or things don’t seem quite right. I’ll talk to another friend and say, “This is how this went.” I’m like, “Why don’t you try saying it this way?” Even if I need to call somebody to vent, I was like, “I need to vent.” I would call somebody because I’m all emotional about something and I can’t think. The first thing is to talk through that. We’ll get the emotion out of it and let’s figure out how we’re going to deal with this. It is having a full network of people behind you, not just for the problems, but even when you’re like, “I’ve never dealt with this before. Who can I call to help me deal with this?” It is another little step in me learning how to do what I do. How do I get a bond to do my project? Talk to this person that can help you do that thing and learning.

You also talked about personal development. How important has personal development been for you in your real estate journey?

It’s everything. I hadn’t grown in my ability to see that. I didn’t realize everybody didn’t think like me for years. It doesn’t make sense to me. How come we’re having this conversation? People don’t think like me. It’s a big call. Sometimes you need bigger conversations than you think you need because that’s not where people came from. That’s not how they think. Learning that one thing, the reason that comes to me is that I have a friend who is a urologist who always likes, “I don’t understand why they don’t do it this way?” They don’t think like you. You think through things in a certain way. I don’t think as you do. That’s why it’s not going to look like you would do it. That seeing somebody else who doesn’t realize how people don’t think the way you do brings it to light.

To me it’s like, “You have to pay attention to the words that are being said.” I also learned all this in medicine. You’re sitting there talking to a patient who’s using words that aren’t necessarily the words you would use. You have to question what do you mean by that? I asked many questions. People ultimately end up getting frustrated with me sometimes because I go for clarity. I don’t want to make any assumptions on what you’re saying or think., “I understand what you’re saying.” That personal development has brought me to that and to see everybody is one of my coaches.

Everybody’s doing something for a positive reason. If you think like that, you can’t get upset with people. It may not be a positive reason. It might not be positive for you but to them, it’s positive. They are doing that for the reason that’s going to benefit them. I am unfortunate. I have two daughters who are 25 and 28, who are grown for who they are. I often call them and tell them what we’ve talked through things. When I went to go to anger on something, my one daughter was like, “Maybe they meant this by that.” It’s hard to be angry if that’s what they meant. Let me get back into that conversation and understand what’s going on.

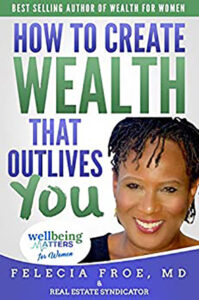

I want to pivot a little bit to your book. You have a book that’s called Well-being Matters for Women: How to Create Wealth that Outlives You. What made you decide to write this book?

This book was published in December 2019. We got to Amazon number one status so that was exciting. It’s number one in one category and then high in several other categories. It’s geared towards women. Women tend to shy away from talking about money. We may not realize that because we will talk about money and not be afraid of it. It’s like it’s the thing. In general, women don’t. Women tend to let their husbands or the man in their life deal with the finances. Even though they run the household, that business of a household, women will run that. When it comes to investing, the majority are, do not. Even though statistics show that women who do invest do very well, mostly because they look at what the investment is before they invest in it.

It is usually important to them. It is not the necklace, it’s not the flash in the pan thing. It’s going to be something important. Knowing all of that, I want women to do well and have options in their life and not be stuck in a 9 to 5, if that’s not what you want. If you love your 9 to 5 and something comes up, you may have to be offered a year. If you have passive income coming in, if you can understand what passive income is and how you do that, you can do the things you need to do and not be at the mercy of your 9 to 5 because there’s no way I can live if I don’t have it.

I talked to a woman in Southern California who had to be offered two years to help to take care of her child who was sick with cancer. They had to go to different places to get these cancer treatments and you have no choice. You’ve got to do that. Fortunately, she had enough real estate investing that her passive income allowed her to be able to do that without that stress being on top of taking care of childhood cancer. That is the reason for that book. You start learning about real estate investing, that’s the number one thing, educate then you can start investing. You have to invest money and time and understanding of different things. Know what’s important to you. Enjoy your life.

To end, I ask all my guests the following three questions. What are you grateful for in your life at the moment?

Nobody wants to have a difficult conversation, but you have to have them if your business is going to grow and move forward. Share on XI’m grateful for a lot of things. I’m grateful for some things I already talked about. I’m grateful for my two daughters who are amazing and who listen. I can call them and talk about something that’s challenging for me. I think that’s important for our children to understand that life is not easy. I grew up and I’d never realized the challenges my parents have. My kids understand that it’s not always an easy life. I’m grateful for that and I’m going to go ahead and add as stressful as they are, the challenges in my life that helped me to grow and run through some things that I know it’s okay. This is a thing, so breathe, walkthrough, go to yoga and drink some water.

This is not one of my top three, but it’s something that I would like to know personally. How do you balance building a real estate business while having a full-time practice as well?

I don’t have a full-time practice. That’s only for the past years. I’m part-time. I didn’t sleep a lot. I would get up from 4:30 to 5:00 in the morning, do my morning thing, get on the computer or do some real estate things and then go to work. I’ll be at work from 8:00 to 5:00. It’s not always 8:00 to 5:00, then come home, do a little bit more real estate, go to sleep, get up and do it again. It was hard. I’d leave work and go to the airport to fly to a meeting and get there. The meetings had been going for an hour or so. Get in there, get what I can get, meet people, talk to people, come back, and go to work. It was hard, but I want this. I’m going for this time where I can work part-time. I’ve decided that I’m closing it down in November after my birthday. I’m going to have a party in November and I’m done with the urology party. People keep saying that you retired. It’s not retiring, it’s tingling. It’s a change.

Why did you want to make this change?

It’s going away from medicine. It has been stressful. We hear so much about the inside of medical care is challenging. Thinking about medicine was full responsibility for somebody’s care, without the control over what they did. That stress has been so much for me. When I learned about real estate and learning that, “I can get this passive income,” which syndication is not a passive job. It’s another job you learned to raise money. You manage people’s money. I have that and I’m also going towards another business, which called 18 Seconds for Health. My overall umbrella company is called Well Being Matters. It’s health and wealth come together. The 18 Seconds for Health is where we help women, help people in general, speak better, talk better, have better communication with their healthcare provider. Those two things, the real estate investing and this other company, this is how I can contribute to the world. It feels good for me. Being in medicine has stopped feeling good.

What do you attribute to your success and continuous growth?

Persistence but another thing is I don’t feel like I’m successful yet. I don’t feel going in there, even though my daughters point out, “You need to be grateful for where you are.” I have achieved a lot of things in my life and I am grateful for that. It is persistence. When things were crap in 2008 and 2009, we had losses. We could go into that whole nastiness, but you have to get up and keep going. This is not the end. This is a thing. What I learned was, “Let’s go.” I think the main thing is persistence and great friends. It seems like the right people show up at the right time for me.

What do you wish you had known at the beginning of your journey that you know now?

It’s how important the team is. How important is having the right people around you, the people that are doing more than you. People who make you feel like you need to step up your game.

This conversation had delivered many good nuggets. Thank you, Felecia, for coming on. I appreciate it.

Well-being Matters for Women: How to Create Wealth that Outlives You

You’re welcome. Thank you, Lisa.

If my readers want to get to know and reach out and get more information about you, what is the best way they can reach out?

The best way is to go to the website, NarwhalInvestmentGroup.com. You could go to WellBeingMatters.mn.co. I’ll send that because it’s a long email address. You can join our Well Being Community where we talk about health and wealth and how to get things done and moving on in our lives. Every single penny of anybody buys that book, goes to The Hunger Project, which is an organization where they call it charity, but you’re investing in people being able to feed themselves. Check out their website, it is amazing. It’s a women-centered program where women are brought up to be able to help their community to be able to feed everybody.

Throughout all of your projects and businesses, they’re all about impact investing. You are doing things for good that are helping people to be sustainable beyond their feet and to be positive and contribute well to society.

That is exactly what I want people to do.

Thank you, Felecia. I appreciate it.

You’re welcome, Lisa.

—

Thank you, Felecia, for coming on this show. I appreciate it. This is an amazing episode. There are many good nuggets. Some of my insights from this episode talking with Felecia, three things consistently came up. One was the importance of teams. Having people who are doing more than you around you that inspire you to do more, be more and show up. She also talked about personal development, which was the second thing that stood out to me a lot. She mentioned the importance of knowing that when you have these goals, most of the time, you’re going to have to become someone else to achieve these goals positively. If someone is going to be more in alignment with their words and integrity. Someone who’s going to show up even when they don’t feel like showing up or maybe it’s something else. Whatever it is, it’s going to require you to grow and to continue to develop and be that person that you are trying to be to achieve these goals that you are looking forward to doing.

I also love that most of her investing in business opportunities is all about investing for impact. Whatever the episode name that I want to come up for this show, it’s going to have something to do with impact investing because it is such amazing stuff. Residential assisted living and how much investing in that space is enabling her to impact the lives of other people positively. In agriculture, thinking about food and how we’re growing our food. This is all about this. You’re still investing in real estate, but the creativity as well as the intentionality of choosing to invest in a way that aligns with how you want to show up in the world and how impactful that is. I enjoyed doing this episode and learning about her, her business and her book.

That’s my last item, her book, Well-being Matters for Women: How to Create Wealth that Outlives You. She noted that it is geared towards women, but men are not excluded from reading the book. You can read it. She talks about how most women tend to shy away from money and investing. To be honest with you, I do find that to be true as well. When I go to a lot of real estate events or finance events, there are generally more men than they are women, but women are known to outlive men. You need to be knowledgeable about your finances and about investing, and how important it is to know what’s going on. It is a good episode with many good nuggets. I hope that you enjoyed it as much as I did. You can find out more information, her bio, her book, as well as being able to contact her on her website. Until next time, keep leveling up. I’ll see you in the next episode.

Important Links:

- Felecia Froe

- Wealth for Women: Conversations with the Team That Creates the Dream The Top Female Professionals Who Can Help You Get Wealthy in Real Estate (A Message In A Bottle)

- Rich Dad Poor Dad

- Residential Assisted Living Academy

- Everything Is Figureoutable

- Well-being Matters for Women: How to Create Wealth that Outlives You

- 18 Seconds for Health

- www.NarwhalInvestmentGroup.com

- https://WellBeingMatters.mn.co

About Felecia Froe

Felecia Froe, M.D. is founder and CEO of Narwhal Investment Group. She earned her MD from the University of Missouri in Columbia and has been a practicing urologist for 25 years. She is currently practicing with The Permanente Group in California where she served as chief of the urology department for 2 years. Dr. Froe has been a real estate investor for over 15 years.

Felecia Froe, M.D. is founder and CEO of Narwhal Investment Group. She earned her MD from the University of Missouri in Columbia and has been a practicing urologist for 25 years. She is currently practicing with The Permanente Group in California where she served as chief of the urology department for 2 years. Dr. Froe has been a real estate investor for over 15 years.

She weathered the recession, learning the lessons that the economy taught. She currently works with investors to help them deploy capital into real assets to help them reach their financial goals. The goal of her company is to provide a significant return on investment as well as return of capital and, with investor partners, help improve the communities in which we invest. Dr. Froe was inducted into the 2001 class of the Kansas City Business Journal’s Women Who Mean Business, she is a best selling author and speaker.

Her other interests include helping patients communicate better with their doctors. Toward this effort she founded the company 18 Seconds for Health.

My websites: www.narwhalinvestmentgroup.com, https://wellbeingmatters.mn.co

Love the show? Subscribe, rate, review, and share!

Join The Level Up REI Podcast Community today:

https://waterfallmagazine.com

Usually I don’t read post on blogs, however I would like to

say that this write-up very compelled me to take

a look at and do so! Your writing style has been surprised me.

Thanks, quite nice article.