When you’re in readiness mode and frustrated enough to want to make a change, then that’s a perfect time to do research and look at your finances. In this episode, you’ll learn how to get your finances ready to invest as a high-income earner. Lisa Hylton’s guest in this episode is Lisa Sierra, a Career Strategist & Impact Coach with a passion for people and a love of possibility. Lisa shares her story of suddenly dropping under the poverty line due to the recession. It’s not an easy place to be, but it did teach her vital money lessons. For one, don’t be afraid to look under the hood at your money. It’s the only way to know what expenses you need to cut and how much you can save for future investments. If you want to make money work for you, you’d love this episode. Join in!

—

Watch the episode here

Listen to the podcast here

Getting Your Finances Ready To Invest As A High Income Earner With Lisa Sierra

I am excited to have on my show an amazing guest. Her name is Lisa Sierra. She is an experienced strategist and coach that has built multi-award-winning businesses. She leads a large innovation customer service and data analytics team in the government. She launched LisaSierra.com to help more people make an impact in their career and financial life, and share her approaches and tools with a wider audience. Starting with family income under the poverty line years ago, she now invests in real estate and is working to build wealth with those around her through empathy and clarity. She has a special talent for negotiating on cars and getting amazing deals for her friends. Lisa, thank you for coming on the show. I appreciate it.

Thank you. I’m excited to be here.

I’m trying to think about how we met again. It was in one of the Facebook groups. Learning about you and your story, we have some synergies, especially when I was at a place thinking about how I can help women and men as they’re thinking about putting together their finances to get to a place of investing. Lo and behold, we met and you were pretty much doing that. We’re going to get into that on the show. Before we get started, the show is broken into three parts. We have a little bit of background. We get into the meat of the episode, and then we end with the Level Up questions. Can you share with my readers, where do you live?

I live in Calgary, Alberta, Canada. It’s thirteen hours from the West Coast, pretty much directly over Idaho and a bit of Wyoming, and a bit of Washington State as well. It’s a fairly big province. I also do work in the US. I follow finances in the US as well as a hobby.

What do you and your family like to do for fun?

We like to hike. I have a St. Bernard Golden Retriever that we take out every day. We like to go out to eat and be together, a lot of lakes and camping and that sort of thing. We like to be downtown, in the mix of nightlife and whatever is happening in our city.

When you’re in readiness mode and frustrated enough to want to make a change, then that's a perfect time to do research and look at your finances. Share on XLet’s get right into preparing to invest. I touched a bit about your story, but touch a little bit about your story and how it resonates with people who are at a place where they want to invest, but they’re not there yet.

There are a lot of people who can identify with our story. My husband and I had great jobs. We both had our own businesses separately. We hit a recession, and both of them were affected by it. H1N1 was a big thing in 2009, much like the pandemic is now, although not to that degree. We saw my husband’s business go down to a quarter of what his revenue was. My business dried up. It was a kid’s play center and coffee house. That was a new concept in the marketplace. We went from being packed to having one customer a day. You can’t sustain yourself that way.

We ended up losing our life savings. With what was left of the income in his business, we were under the poverty line. That’s a scary place to be. Others are there as well or living paycheck to paycheck. They believe that investing is for something way down the road or something that they may never get to do, so why bother if we’re always going to be in debt? It doesn’t have to be that way. Part of it was feeling that panic and realizing I need to figure something out. I’ve always had a love of budgeting, meal planning, and trying to figure out cost-saving ways to do things without affecting the net result. Our kids never had any idea that we didn’t have any money because we focused on free experiences and doing things as a family that we could and that didn’t cost money.

It was partly the getting into that readiness mindset. Knowing that I’m frustrated enough with our current situation. I want to see all the options that I can take on to change that situation. When you’re in a situation where you make a finite amount of money, there’s only a couple of things you can do. You can find something that makes more money or add on a side hustle. You can cut your expenses, or you can do a combination of those two. Some of the things that people do to try to make more money, I try to steer them away from some of the MLMs because there’s an initial investment upfront. There are some side hustles that you can do that don’t require much of an investment upfront.

There are groups on Facebook that talk about side hustles and have lists of them. There are some great options on Pinterest. What I talk to people about is when they’re in readiness mode, and they’re frustrated enough that they want to make a change, that’s a perfect time to go into a little bit of research mode. Start to look at your own finances and figure out what you’re afraid of. If you’re afraid of the unknown, then you’re not going to want to look at your finances. A lot of the people that I coach don’t open their bills. They are burying their head in the sand a little bit about the state of their finances, their credit scores and things like that. They think, “I don’t need to know that. It’s not going to affect me.” The best thing that you can do is understand what the problem is, then everything is up from there.

To go back to the readiness mindset, I’m glad that you start there because the reality is you can bring a horse to the well, but you can’t make the horse drink. There needs to be sufficient pain where the person feels that they are ready to make a change in their life. Moving on from there, you said to get into research mode to research all the different types of options that are available to them.

Ready To Invest: Take baby steps on cutting down your expenses.

Not getting too overwhelmed with those options. There are going to be a lot of options but figuring out if you’re looking to cut your expenses first, you’re looking to create more income, apply for new jobs, or whatever that looks like. Focus on one of those first. Otherwise, what a lot of people will do is they’ll put all these options on the table and then they can’t pick any. They become paralyzed. Focusing on one path first and taking some baby steps, “What are those things and areas where I can cut my expenses?” When you have that readiness mindset, you’re ready to say yes. If it means I must make some hard decisions about coffee or using my cell phone less or not having some extras, then that’s what I’ll do.

Some of those biggies are travel, shopping, etc. that aren’t necessarily concerning. Before we move on here, for people who feel that they’ve cut their expenses as much as they can. You noted that there are some areas where Facebook groups are like a gold mine in finding guidance and support into looking at side hustles. What would you recommend in terms of some of the groups that have stood out to you or other places?

Groups like Her First $100K, some of the TBM Family, Road To 750, that’s about building your credit score. A lot of people ask those questions about side hustles in there. You can search in the group and find a long thread that has all the options of side hustles. I find that if you go directly looking for side hustles, you get a lot of MLMs or Multi-Level Marketing, where you’re selling to others. That’s not for everyone. There are some opportunities. People will talk openly about what the pros and cons of some of these side hustles are, how much time it takes, and what knowledge you need. You can search for no special training or those keywords, and you’ll still find some options for you.

In your practice of helping people, as you were breaking down, what are some of the other things as people come? Debt is a big thing. In terms of tackling debt and investing, what are your thoughts there in terms of when a client has large amounts of debt, either student loans or consumer debt, and then they also want to invest? What have you seen have been good ways to navigate that?

I find that having a balance is the best way to go. Otherwise, if you’re always focusing on debt, it can create a sense of lack in your life and make you feel like you don’t get to do anything until you tackle all this debt. Particularly in the US, some of the student loan debt is quite high. If you’re looking at $100,000 or $200,000 in student loan debt, you may think, “I can’t invest for twenty years.” It’s about a balance. I recommend people build an emergency fund first so you’re not dipping into moving your categories around and trying to figure out, “How do I get this tire that was flat and get that fixed, or upgrade my furnace,” or whatever that might be. Have that emergency fund and a safety net.

Once I had an emergency fund, I found it created a sense of stability that I didn’t expect. That allowed me to then start thinking about those other options. At the same time, as tackling debt, I built a fund for investing. In the beginning, it was $25 every pay and I get paid bi-weekly. Every two weeks, I was putting in $25 and then I kept upping it. I started doing little things like saving $5 bills. I have a compulsion, my family laughs because I will buy their $5 bills from them because I save them. At the end of the year, I have quite a sum to deposit and use for investing or Christmas, whatever that might be that is something unexpected and it’s a nest egg.

In 90% of all households, women make the day-to-day financial decisions. Share on XWhen you start thinking in those terms, every little bit counts. By starting to invest slowly, over a year, I was able to build up $1,500. Little bits here and there. Once you start to get an amount like that, it creates the, “I want to do more of that. I want to get more of that.” You’re still paying down the debt, but you’re starting to see the other side rise. It shifts your mindset into getting into that mode.

As people now have $1,500 or $2,000, $5,000 or $10,000 that they want to invest, what are some of the things there that you will help them through?

I would connect them with somebody like you who has investment opportunities. I would understand what those thresholds are for different opportunities. Because I’m not an investment professional, I would direct them to those folks. I build a network closely with others who have investment opportunities, and then they would do their own due diligence and make sure that that’s right for them. If they are specifically saying, “I’m interested in real estate,” then I want to have some professionals come in into my groups and talk about, “Here’s what some of the options are.” They can start to say, “It’s like a menu. ” If a waiter or waitress comes to you and they have a menu, you then can choose to order what you like off the menu and in the budget that you have.

A couple more things on gender and personal finances. What have you seen in terms of the interrelation of those two, and the long-term impact for both?

In families quite often, we’ve not been taught finances because our parents didn’t know either. Forbes did a study and they found that 90% of all households, the women make the day-to-day financial decisions in the household. There are a lot of places in that household budget that you can make adjustments and make decisions that will affect the future. As women, we have a great opportunity there to take on some ownerships around where do we go as a family, and how do we build generational wealth as a family. Women are connectors by nature.

We work well by collaborating and learning from others and supporting one another. I try to create these support groups that can help keep you accountable, but then also help give ideas, and help you move forward through the steps of getting to the place where you’re ready to invest. Having that cheering section behind you and other women who are going through the same thing can help you learn and accelerate that learning.

Ready To Invest: Build an emergency fund first.

That’s so important. You talked about groups and accountability. A lot of times, I find that people sometimes are surrounded by other people who might not be thinking about these kinds of things. They might not be thinking about investing, saving or anything of that nature. I feel as though it’s powerful to then be in community with other women or other men or other people that are focused on doing this stuff. That helps you to continue showing out for yourself and your future.

My passion is around those people who haven’t had those opportunities. It’s women coming out of long-term relationships, and they haven’t had to do their own investing before or newly managing their own financial future. People of color who haven’t had those opportunities that others may have had. How can we start to leapfrog them to where they need to be? It’s by giving them the tools and the information that they need to move forward. The other part is the relationship part. I work closely with a social worker who’s a counselor. We work together with people to talk through and figure out strategies I’m working through with their partners in a non-conflict way.

Sometimes it’s trying different strategies around the conversation. Sometimes it’s giving them information ahead of time to say, “I want you to think about this, and then I want to talk about it next week. I want us to go for a drive and have a conversation about this.” I’m giving them some information that they can look at ahead of time. Sometimes it’s about stepping back and talking about what are our shared goals together, and then getting agreement on that, and then starting to move into the more challenging conversations. Not often are both partners ready at the same time. As women, we can often strongly influence the direction the family goes.

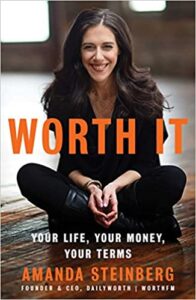

I was introduced to a book called Worth It. I’m not sure if you’re familiar with that book at all. It talks a little bit about women who have been able to earn good money. They are either earning six figures or they’re breadwinners. They’re noticing that they’re at a point in their life where their expenses have grown in proportion to their income. Can you talk a little bit about people who resonate with finding themselves in that category where they’re making six figures and they’re thinking, “I would like to invest. If I lost my job tomorrow, I would be on a good footing.”

That’s common. Our society thinks that if you’re making six figures, you should have this bag, car or whatever. There are rising costs to those things. When you’re looking at your budget, what are those things that you can cut back on, do less of, not do at all or stretch out? One of the things I stretched out was getting my hair colored and highlighted. I moved it out. I went a slightly different color, so I could go an extra month and a half. When you do those things, it gives you a little bit of flexibility. There’s an embarrassment factor with women who believe they’re high achieving in their jobs, they’re making six figures, they look put together, yet their bank account and investments do not reflect that.

Always have a backup plan and a backup to the backup plan. Share on XWhen you help them come together with a small group of women who are doing the exact same thing and are in the same place or have been there, it helps especially with empathy. I have no judgment. I’ve been there. I’ve seen both sides. Before I did my business, I was in that state as well. I kept thinking, “Why can’t I figure this out? How can I do so well at all these things but I can’t seem to get ahead in my finances?”

By creating that network and that learning for myself, I have a group of girlfriends that loves financial discussions and learning stuff together, it helped keep me accountable. You need a safe place to say, “This is how much I’m in debt.” Own it and be accountable to it and then say, “That’s where I was, not where I’m going. I have this goal to invest in real estate. This is what I want to do.” You start to help them with language around saying no to certain things or making little adjustments to their lifestyle that starts to help them see some savings.

Do you have situations where your clients are at a place where they want to buy their first real estate property to live in? Their goal might not necessarily be real estate investing, but they want to buy the first condo or their first single-family home or duplex or something of that nature. What are some of the things there that you coach them around having put together so that they are in a good spot for that purchase in their life?

We talk about the expense piece, and we have them live that way for six months. We all know that it’s human nature that if we move into a new property, we suddenly need several new things. We need a new couch, sofa, curtains, whatever it might be. If you’re going into a mortgage, taxes and utilities on a new property, and you struggle living that way for six months leading up to it, then you need to rethink your budget or look at, “Is there another way I could do this? Is there more of an investment property that I could live in that isn’t strictly just for me, and has an additional unit or have a roommate for a period of time?” Whatever that might look like, there are some options that you can take on.

I’ve seen that particularly as well when somebody is getting divorced. They’re left taking over the mortgage on a house. They’re suddenly faced with a higher mortgage but lower-income and how do they manage that. There are a number of options they can do. Different areas of the country have different things you can write off, home office pieces and things like that. There are certainly options when you’re looking at a property. One of the things I try to think of and get people to think of is, “If worst-case scenario happened, what would I do? What are my options in that situation?” Knowing what my options are means that I always have a backup plan and a backup to the backup. It gives you some sense of certainty that if the worst happened, if I lost my job, then I know exactly what I would do.

I know you’re based in Canada, some of the laws surrounding prenuptial agreements and post-nuptial agreements are a little bit different than in the US. What do you coach people who are getting married later in life and who have taken the steps of correcting their finances to get to a stronger place? They might be bringing to that marriage, assets. Do you provide any coaching or refer them to get coaching around that?

I would refer them. In Canada, there are a couple of groups and local individuals that I would refer them to. If they’re in the US, I would refer them some quick searches and I can find some local resources for them because I do have US clients. Part of it is asking the right questions. Asking yourself and having that discussion with your partner about money. Understanding what their knowledge of money is, where they see your future together, and what they see as values. Starting to have those value discussions around money if they haven’t already will start to draw out if we’re aligned when it comes to money, and what do we both see as those opportunities with our money.

I would recommend later in life getting a prenup as part of the paperwork of getting married. I also would recommend having those discussions around money. If you can’t have them now, that’s something that either you might want to think about resolving beforehand. Not because you don’t love each other, but because you were brought up with different money blocks, money mindsets, and money stories. If you grew up poor, if you grew up thinking you were poor, if you have this “We can’t afford it” mindset, if you had a lavish lifestyle and never had to worry about money, those two partners together are going to come into conflict. How do you make sure, especially if one’s a saver and one’s a spender, that you don’t always put the saver in the position of being the police of the money, and then in the position of being in charge of the fun with the money?

This is such a good conversation. Thank you so much. We’re going to move right into the Level Up questions that I ask all my guests. The first one is, what are you grateful for in your life right now?

My family is one of those things, but my curious mind is the other thing. I say it on my website, I have ADHD and a lot of people can see that as a challenge. I’ve always seen it as an opportunity. It means I’m intensely interested in many things. I can follow many paths and get good at a number of things, then I’m done. I’ve learned as much as I want to about that subject, then I move on. The way my brain works allows me to connect all those interesting pieces together and use them in other disciplines. I can use my practice in art and in the work that I do every day. I can use my interest in neuro leadership and I can use that in helping people have those conversations that are sometimes challenging. It all blends well together. Luckily, I have one of those brains that are super curious about people and why things work the way they do.

What would you say has attributed to your success and continuous growth?

Part of it is my family. My family is always learning things and they’ve always encouraged us to learn and take courses. My dad is still taking university classes in subjects that he’s interested in. That’s one of those things, having that growth mindset that what I know is not everything. I can always learn something from other people, cultures, ways of doing things and approaches. Having a growth mindset means that it’s expandable and I can be open to many things, and that includes food. I love trying new food and all that stuff.

What do you now know that you wish you knew at the beginning of your journey?

When I first graduated from college, I wish I had known about my financial life and started investing young. That’s what we’re trying to set our daughters up with. We’re trying to make sure that they understand that money is a tool and an asset that they can use to disconnect some of the emotional things about how buying things can make you feel a certain way, and experiences are what we’ve always focused on.

Don't be afraid to look under the hood at your money. Share on XHopefully, those things stick. They’re going to make their own mistakes and they’re going to make their own successes, but we’ll be there to coach and help from the background. Hopefully, we’ll set them on a path that serves them well. I wish young graduates knew some of this information as well. That’s why I have a new grad program as well. If you’re young and before you get used to making that first big salary, then get used to living on a portion of it, and then seeing your money grow like crazy.

Anything that I didn’t touch on that you think would be good to touch on before I have you also close out with promoting where people can learn more about you?

Don’t be afraid to look under the hood of your money. Take a detached approach. Take a month’s worth of statements. It’s one of the things where I have someone else sit beside me and do it. I call out the numbers and what column they should go under. We have them add it up and it’s like $1,171. It takes the emotion out of the fact that you spent $600 on eating out and you threw out $600 worth of groceries or whatever that looks like. You have a full set of information around, “I spend that much on this? I can cut that down.” You’ll find little places for your money that you didn’t even know was there and was slipping through your fingers.

If my readers want to learn more about you and your services and programs, what’s the best place they can go.

They can go to LisaSierra.com. I’ll be launching some new programs for some cohorts. If they want to do a one-on-one where they want to get their financial house in order, and get some steps in some accountability, some worksheets and templates, I’m happy to do that. I’ve got some free templates for your audience.

Thank you, Lisa, for coming on. I appreciate it.

You’re welcome.

Important Links:

About Lisa Sierra

Lisa Sierra is an experienced Strategist and Coach that has built multi-award winning businesses and also leads a large Innovation, Customer Experience and Data Analytics Team in government. She recently launched www.lisasierra.com to help more people make impact in their career and financial life, and share her approaches and tools to a wider audience.

Lisa Sierra is an experienced Strategist and Coach that has built multi-award winning businesses and also leads a large Innovation, Customer Experience and Data Analytics Team in government. She recently launched www.lisasierra.com to help more people make impact in their career and financial life, and share her approaches and tools to a wider audience.

Starting with a family income under the poverty line 10 years ago, today she invests in Real Estate and is working to build wealth with those who work with her by focusing on the basics of budgeting, mindset and conflict that can be barriers to becoming an investor. Lisa specializes in making challenging conversations positive, leading with empathy and clarity and she has a special talent for negotiating cars and getting amazing deals for her friends!

Those wanting to work with her become part of a connected co-hort who challenge and support each other and themselves to make financial progress and can choose from One on One coaching and Cohort options.

She has Leadership Certificates from Ivey School of Business (Western Ontario University), Schulich School of Business (York University), Harvard Kennedy School of Government (Harvard) and a diploma in Urban Planning from Northern Alberta Institute of Technology and is a former business planner and financial strategist.

Her love of personal finance came from wanting to make life better for her family and includes ongoing learning including courses, podcasts, webinars, books and using tools from neuro-leadership, conflict resolution, character based leadership, strategic leadership, innovation, digital transformation and team development using system design.

Love the show? Subscribe, rate, review, and share!

Join The Level Up REI Podcast Community today:

Recent Comments